The power of the founding team

When envisioning a successful startup, the image of a dynamic and driven founding team often comes to mind. This group of individuals, united by a shared vision and a passion for innovation, plays a critical role in shaping the trajectory of a new venture. But what is the optimal number of founders for a startup? What are the characteristics of a good founding team? And what skills should these founders have?

This article delves into the significance of the number of founders in startups and explores both the advantages of larger teams and of smaller teams. This is summarized to describe the ideal founding team, some final important considerations about founders dynamics and complementarity are shared to add some nuance. To finish, a simple framework using skill buckets is discussed that is used by investors to determine the skills of the founding team and the first hires.

This article is co-authored by Olivia Vandesande, an advisory board member at Angelwise. With a background as a senior executive in HR and merger reorganizations, she made the decision to join Skelia, a scale-up founded by her partner. Skelia is the international leader in building cross-border IT and engineering organizations in Eastern Europe . From 2016 to 2023, she successfully led the Polish branch, overseeing Skelia’s growth to over 400 employees. Subsequently, Skelia was acquired by Nortal, and Olivia became active at Angelwise.

More founders is better

When you are contemplating launching a startup as a solo founder, consider teaming up with a select few individuals. Here is a short list of reasons why more founders could benefit the success of a startup in the early days.

- Division of labor: larger founder teams mean specialized roles, increasing efficiency and leveraging strengths.

- Broader network and resources: founder teams bring diverse networks, connections, and resources, benefiting the startup's growth.

- Resilience and continuity: multiple founders ensure resilience and continuity during challenges.

- Investor perception: investors prefer founder teams for shared commitment and a collaborative approach.

- Complementary skills and knowledge: diverse founders enhance problem-solving and innovation skills. A range of perspectives and expertise will lead to a more adaptable startup.

Less founders is better

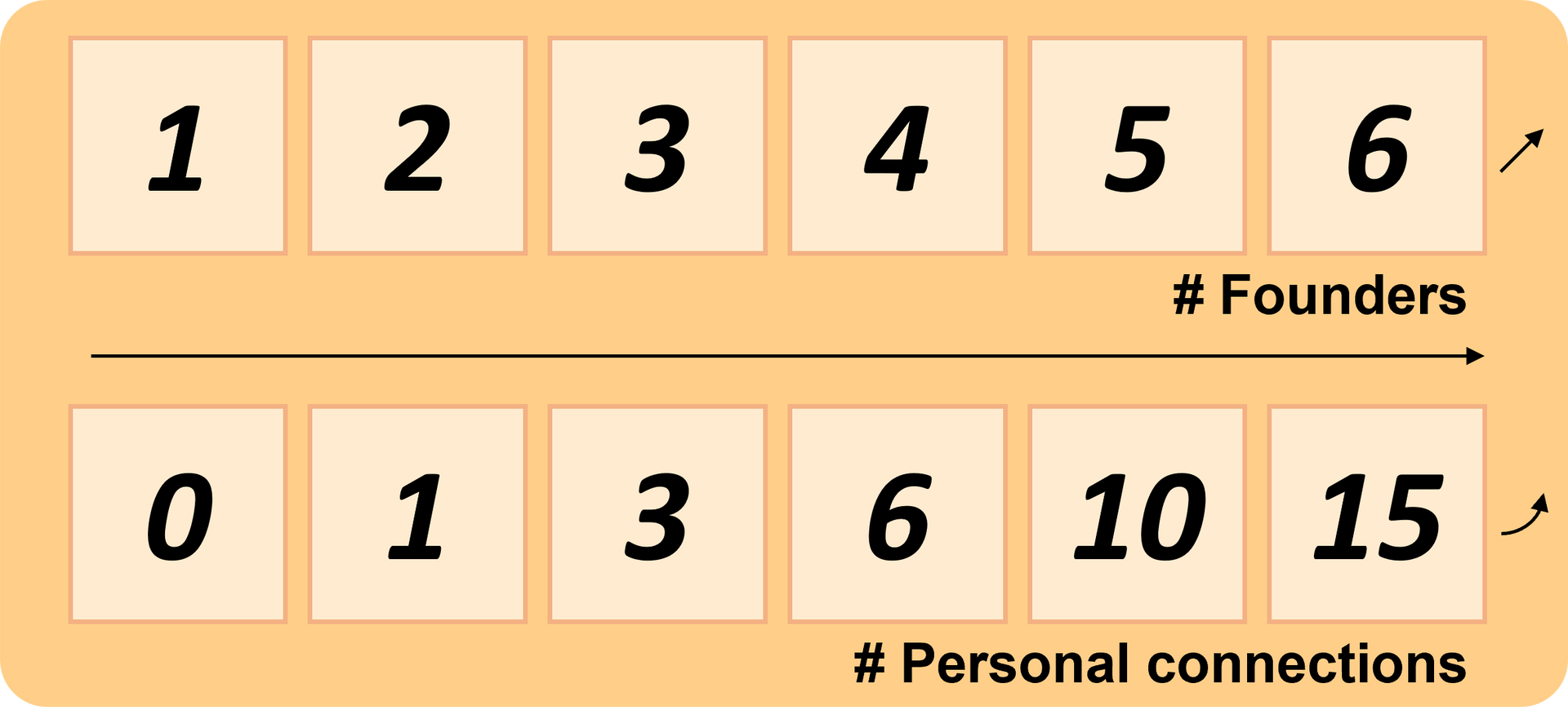

Having multiple founders could contribute to an increase in startup failure rate due to founder conflicts within the team. In a one-founder scenario, there is a limited number of people connections, and conflicts can arise primarily between the founder and external parties or staff. However, as the number of founders increases, the potential for conflicts grows with each additional connection. The number of personal connections increases rapidly after 4 founders with 6 personal connections between them.

This can be attributed to differences in opinions, decision-making styles, and priorities.

Yet having less founders can also be a benefit, this dynamic can be explained by the following 5 points:

- Efficient decision-making: a small team ensures efficient decision-making with streamlined communication and quicker consensus, allowing agile responses to changes and opportunities.

- Stronger cohesion and alignment: strong cohesion is fostered through deep understanding, shared vision, effective communication, and enhanced collaboration among team members.

- Flexibility and agility: the flexibility and agility of a small founding team enable them to navigate challenges, make quick decisions, and implement adjustments with ease.

- Cost-effectiveness: for early-stage startups, a small team addresses resource constraints by minimizing variable costs, making them more cost-effective.

- Stronger personal connections: in the early stages, small founding teams build strong personal connections with stakeholders, providing personalized attention, building trust, and gaining a competitive advantage.

What is the perfect size?

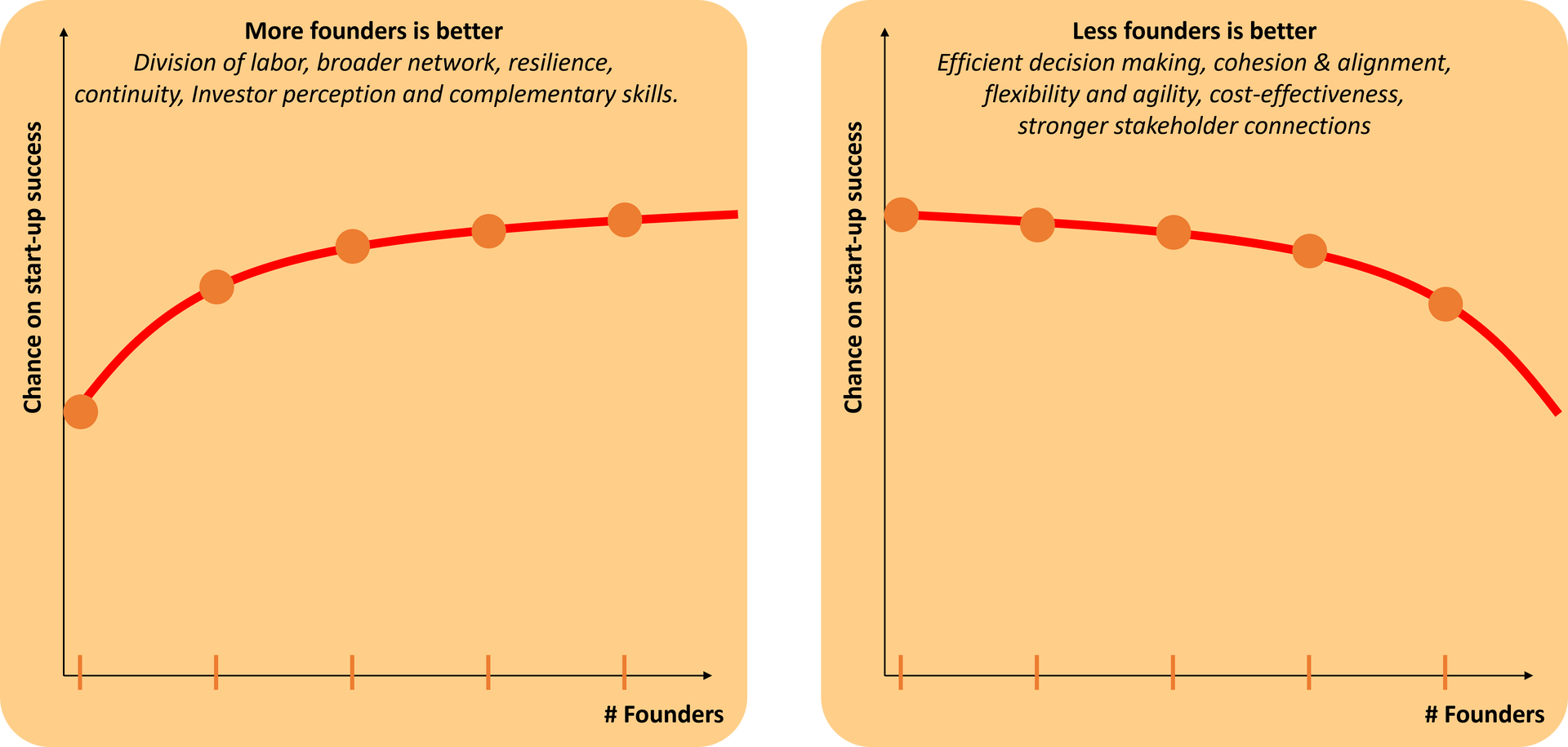

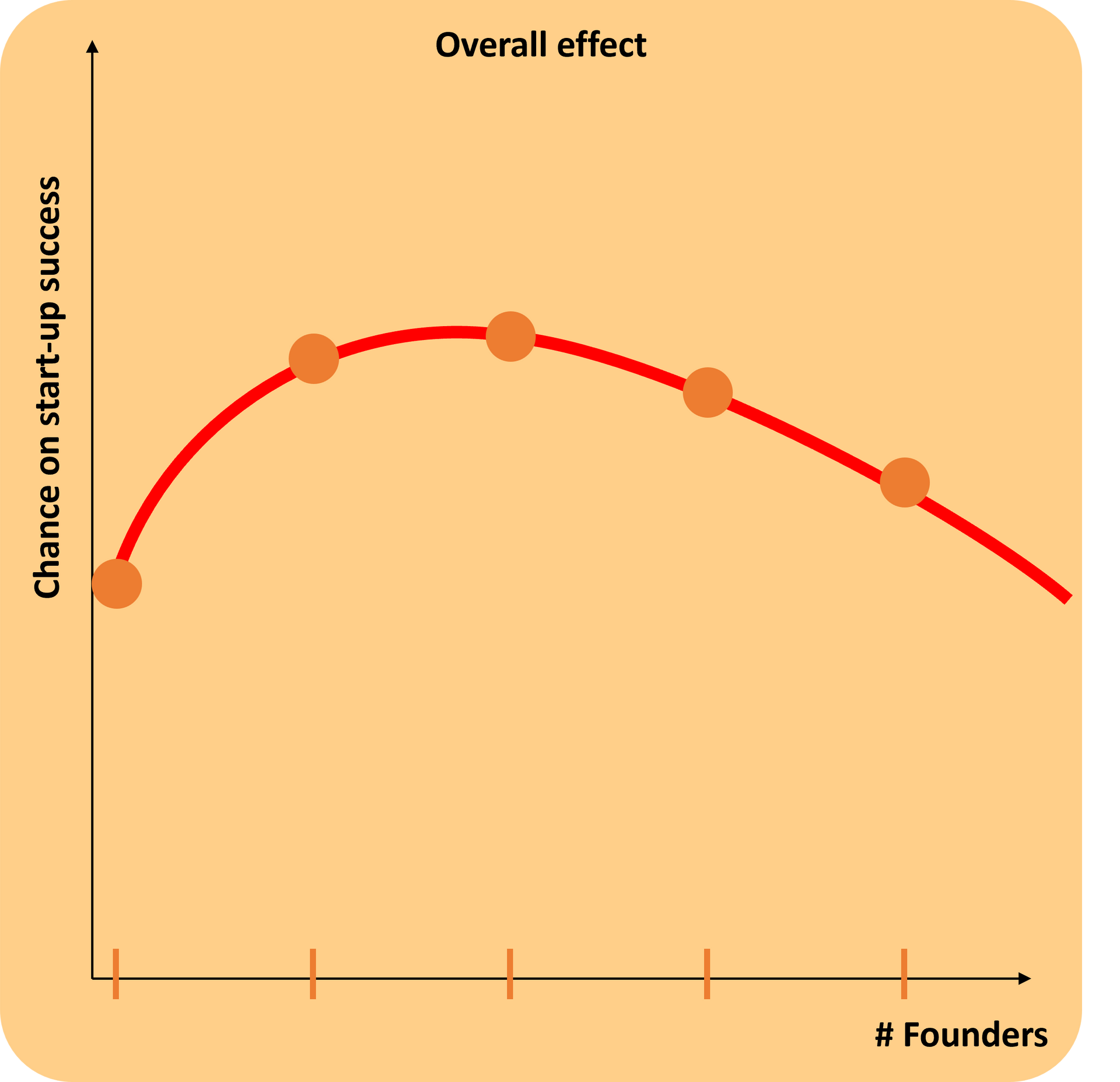

The above described effects can be summarized in the graphs below. Both graphs have the number of founders on the x axes and on the y axes the chance of startup success.

These 2 graphs can be summed and normalized to have an overview of the complete effect. Note that none of these graphs are constructed using concrete datapoints, they are merely used to represent the underlying idea.

It's important to note that the optimal size of a founder team may vary depending on the specific startup, industry and circumstances. The key is to strike a balance where the team is large enough to bring diverse perspectives and capabilities but not so large that coordination and decision-making become cumbersome. Other considerations when finding this balance:

- The quality and nature of the relationship among founders plays a determining role in the success of a startup. Respect and unity serve as crucial catalysts for achieving positive outcomes. When founders and early hires demonstrate effective teamwork, it sets a favorable precedent, especially since they will eventually have their own teams to manage.

- Voting rules (e.g. unanimous, simple majority, qualified majority) can play an important role in decision making between founders. The importance increases after an investment round so be sure that you have sorted this out in the beginning.

“Founders need to understand each other on a deeper level. In Dutch we say “Het schoentje mag niet wringen”, meaning that there can’t be any friction.” – Olivia

- In the previous and following quote we want to draw your attention again to the relationship between the founders. Is everyone aligned? Some people might invest cash and others don’t. Is everyone involved for the long game?

“Around thirty-three percent of marriages end in a divorce in Belgium.

Sixty-five percent of startups fail due to founder conflict. Choose your partner(s) wisely.” – Ruben

- Complementarity, as already mentioned, is a key differentiator between good and amazing founding teams. Do the founders want the same things? Are their visions aligned? Are the roles and responsibilities crystal clear? But mostly do the founders have a complementary set of skills and capabilities.

- The last points introduces the subject of the next chapter where we will do a deep dive on those capabilities and how they can be mapped.

Founders team through the eyes of investor: skill buckets

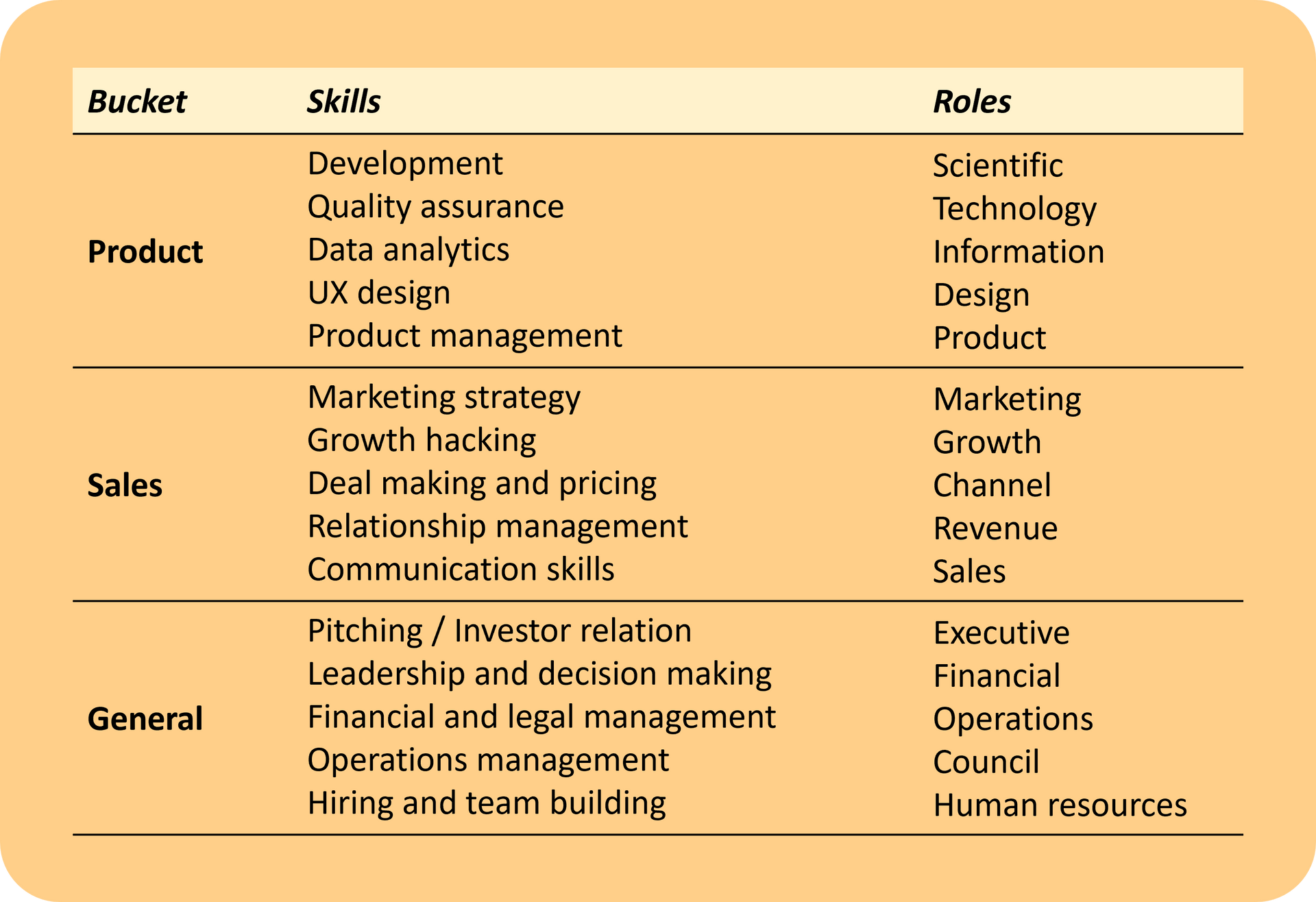

When investors assess a startup team, they often seek to understand the collective skills and expertise that the founders bring to the table. To evaluate the team efficiently, Angelwise maps these skills into three primary buckets: product, sales, and general.

The product bucket comprises individuals who are instrumental in developing and delivering the startup's product or service. This includes roles such as product managers, technology officers, developers, testers, analysts, and front-end and back-end specialists. Their skills revolve around product ideation, design, development and quality assurance. They ensure that the startup's offerings align with market needs, are technically robust, and deliver a good user experience.

The sales bucket encompasses individuals who excel in marketing, growth strategies and sales. These team members possess the ability to effectively promote the startup's offerings, acquire and retain customers and drive revenue growth. Their expertise lies in understanding market dynamics, crafting compelling value propositions, and executing successful sales and marketing campaigns.

The general bucket encompasses individuals who contribute to the overall functioning and growth of the startup. They possess skills in areas such as hiring and teambuilding, legal, finance and fundraising, and operations management. These team members are responsible for building a talented workforce, managing financial resources and optimizing operational processes to drive efficiency and scalability. They are also responsible to translate the service or product (build by the product teams) you are offering in commercial/legal agreement (sold by the sales teams), this is generally one of the first skills where startups need external experts for help.

By categorizing the skills of the founding team into these three buckets, we can gain a quick overview of the team's capabilities and how well-rounded it is. A balanced team with complementary skills across sales, product and general areas is often seen as favorable. Such a team demonstrates the ability to develop innovative products, effectively bring them to market, and efficiently manage the startup's operations and resources.

We recognize that a startup's success hinges not only on a compelling idea but also on the team's ability to execute and navigate the challenges of building a business. Therefore, a thorough evaluation of the founding team's skills (and first crucial hires) in sales, product, and general areas provides valuable insights into the team's potential to drive growth, adapt to market dynamics, and ultimately deliver returns on investment.

“From my perspective, a CEO must possess the ability to drive sales since it forms the lifeblood of all commercial enterprises and remains the topmost priority. The team should complement each other, while also understanding each other's roles crucial for guiding the company towards success. Let me add, as a final remark, that at least one founder, and preferably the CEO, should have also a broader knowledge and understanding of each of the skill domains of the other departments” – Olivia

“Understanding the skills and qualities of the founding team is absolutely crucial. Anticipating strong sales performance every quarter from someone

who doesn't excel at sales could have devastating consequences.

The same applies to the product team; it's unwise to expect

a blacksmith to build an electric car.” – Ruben

Below is an overview of the three buckets (product, sales, and general), the corresponding skills, and the connected C-level roles. It can be a good exercise for the founders & startup employees to map their skills on the genius zone framework introduced in our article “The entrepreneurial journey towards growth”. (link)

Reflection: What does this mean for you?

Be aware that every situation is different, you are the judge on how this applies to you and your startup. Are you aware of your skills and the related bucket? Do you use such a framework in your daily operations, e.g. to consider the profiles of new hires?

Share your ideas and viewpoints with us, and we might take them up in another newsletter or blogpost.

Contact us at mail@angelwise.be

Sources:

- 33% of marriages end in a divorce in Belgium: Article

- 65% of startups fail due to founder conflict of startups fail due to team conflict: The Founder’s Dilemmas Academic reference